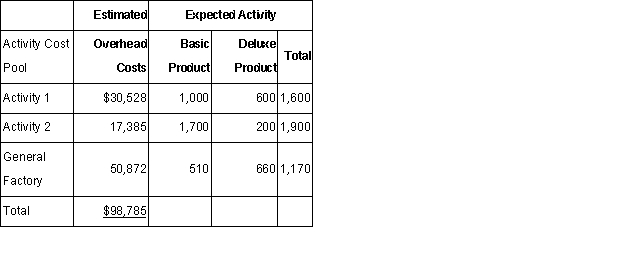

Markham Company makes two products: Basic Product and Deluxe Product.Annual production and sales are 1,700 units of Basic Product and 1,100 units of Deluxe Product.The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products.Basic Product requires 0.3 direct labor hours per unit and Deluxe Product requires 0.6 direct labor hours per unit.The total estimated overhead for next period is $98,785.The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports.The new activity-based costing system would have three overhead activity cost pools-Activity 1,Activity 2,and General Factory-with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor hours. )

The predetermined overhead rate (i.e. ,activity rate) for Activity 2 under the activity-based costing system is closest to:

Definitions:

Section 1231

This is a section of the U.S. Internal Revenue Code that provides favorable tax treatment for gains and losses on the sale or exchange of certain types of property used in a trade or business.

Capital Losses

Capital losses occur when the sale of a capital asset, such as stocks or real estate, results in a loss, which can offset capital gains for tax purposes.

Carry Forward

A tax policy that allows individuals or companies to use a current year's tax losses to offset future taxable income.

Section 1231

A section of the U.S. tax code that allows for the favorable tax treatment of gains and losses on the sale or exchange of business property.

Q3: Dawson Corporation produces a product called Blocker,which

Q5: In October,one of the processing departments at

Q29: Which of the following is not an

Q67: The following selected data were taken

Q76: Job 7890 was recently completed.The following

Q83: Toxo Chemicals produces a solvent in

Q96: In general,weighted-average costing is simpler to use

Q110: Fence Industries is preparing its annual

Q121: Prestige Financial Credit Company produces two

Q123: Dickerson Corporation has provided the following