The following information is for Ogden Company for the month of November:

a.Factory overhead costs are applied to jobs at the predetermined rate of $80 per labor-hour.Job X-14 incurred 2,300 labor-hours;Job SM-4 used 1,850 labor-hours.

b.Job X-14 was shipped to customers during November.Job X-14 had a gross margin of 24 percent based on manufacturing cost.

c.Job SM-4 was still in process at the end of November.The company closed the overapplied or underapplied overhead to the Cost of Goods Sold account at the end of November.

d.Factory utilities,factory depreciation,and factory insurance incurred is summarized by these factory vouchers,invoices,and cost memos:

e.The Company purchased the following direct materials and indirect materials:

f.Direct materials and indirect materials used are as follows:

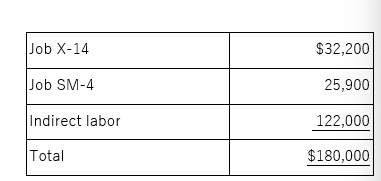

g.Factory labor incurred for the two jobs and indirect labor is as follows:

Required:

1.Calculate the amount of overapplied or underapplied overhead and state whether the cost of goods sold account will be increased or decreased by the adjustment.2.Calculate the total manufacturing cost for Job X-14 and Job SM-4 for November.

Definitions:

Positioning

The process of establishing a brand or product in the mind of customers relative to competitors’ offerings.

Mental Image

A representation of sensory experiences created in the mind, not immediately present to the senses.

Marketing Support

Services or activities provided to assist in the planning, development, and execution of marketing strategies and campaigns.

Product Pullout

The process of removing a product from the market or discontinuing its sale, often due to poor performance, safety concerns, or changing market conditions.

Q24: Item I51 is used in one

Q37: Thane Company is interested in establishing

Q38: Galaxy Corporation uses the FIFO method

Q50: Before prorating the manufacturing overhead costs at

Q98: The College of Business at Northeast

Q120: The following information has been gathered

Q128: If a company multiplies its predetermined overhead

Q134: Faucette Corporation has provided the following

Q136: Parton Company,a manufacturer of snowmobiles,is operating at

Q160: Cost-volume-profit (CVP)analysis is more complicated for organizations