Several years ago Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transaction.

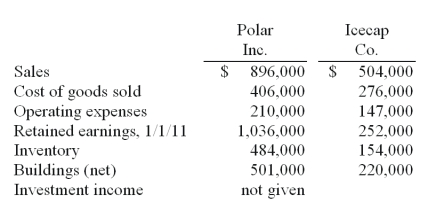

The following selected account balances were from the individual financial records of these two companies as of December 31, 2011:

-Assume that Polar sold inventory to Icecap at a markup equal to 25% of cost. Intra-entity transfers were $130,000 in 2010 and $165,000 in 2011. Of this inventory, $39,000 of the 2010 transfers were retained and then sold by Icecap in 2011 while $55,000 of the 2011 transfers were held until 2012.

Required:

For the consolidated financial statements for 2011, determine the balances that would appear for the following accounts: (1) Cost of Goods Sold, (2) Inventory, and (3) Noncontrolling Interest in Subsidiary's Net Income.

Definitions:

Antibodies

Antibodies are proteins produced by the immune system to recognize and neutralize foreign objects like bacteria and viruses.

Pathogens

Pathogens, including bacteria, viruses, fungi, and parasites, are organisms or viruses capable of causing disease in their host.

IgA

Immunoglobulin A, a type of antibody that plays a crucial role in the immunity of mucous membranes.

Activated T Cells

T lymphocytes that have been stimulated by an antigen to proliferate and carry out immune responses.

Q4: What documents or other sources of information

Q8: What is the adjusted book value of

Q14: What amount will be reported for consolidated

Q23: Matthews Co.acquired all of the common

Q54: What amount of goodwill should be attributed

Q60: Which one of the following varies between

Q69: Which one of the following accounts would

Q80: Eden contributes $49,000 into the partnership for

Q103: Assume that Bullen issued 12,000 shares of

Q114: What is the total of consolidated cost