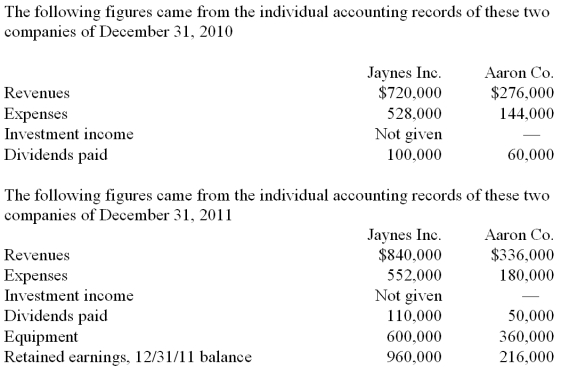

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

-What was consolidated equipment as of December 31, 2011?

Definitions:

Materials Quantity Variance

An analysis used to assess the discrepancy between the expected amount of materials and the actual amount used, based on standard costs, providing insight into manufacturing efficiency.

Quantity Standard

The expected or established amount of materials, labor, or overhead that should be used for a unit of production or a specific task.

Price Standard

A predetermined cost that should ideally apply to a product or service based on expected efficiency and expense.

Raw Materials Quantity Variance

The difference between the actual quantity of raw materials used in production and the expected quantity, which can indicate efficiency or waste.

Q14: What amount will be reported for consolidated

Q16: How should a permanent loss in value

Q21: Prepare Panton's journal entry to recognize the

Q26: How would you account for in-process research

Q52: In Cale's accounting records,what amount would appear

Q66: Pursley,Inc.owns 70 percent of Harry,Inc.The consolidated

Q74: Compute consolidated inventory at the date of

Q85: What is the balance in Cayman's Investment

Q102: What amount will be reported for goodwill

Q110: Prepare journal entries for Virginia and Stateside