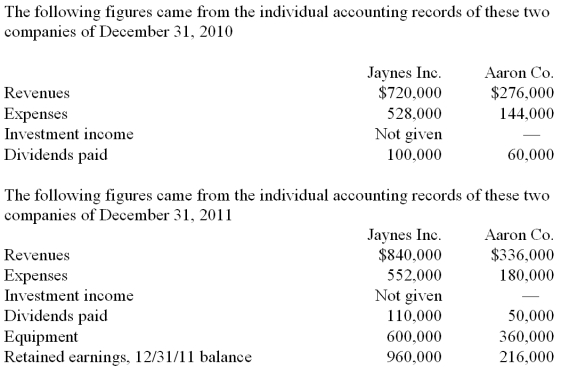

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

-What was consolidated patents as of December 31, 2011?

Definitions:

Dentition

The arrangement or condition of the teeth within the mouth.

Finger-like Projections

Extensions found on the surface of certain cells or within bodily organs that increase surface area for absorption or sensory perception.

Mucosa

The moist, inner lining of some organs and body cavities, such as the nose, mouth, lungs, and stomach.

Villi

Small fingerlike projections that extend into the lumen of the small intestine, increasing its surface area for absorption.

Q1: The concept of groupthink suggests that the

Q6: Which of the following internal record-keeping methods

Q11: The Soviet policies of perestroika (economic reform)and

Q12: Assume that Botkins acquired Volkerson on January

Q15: Constructivists believe that a state's _ and

Q20: A _ feminist focuses on valorizing the

Q38: Which factor must be associated with each

Q48: On October 31,2010,Darling Company negotiated a

Q70: Marxist approaches to international relations hold that

Q109: If push-down accounting is used,what amounts in