Figure:

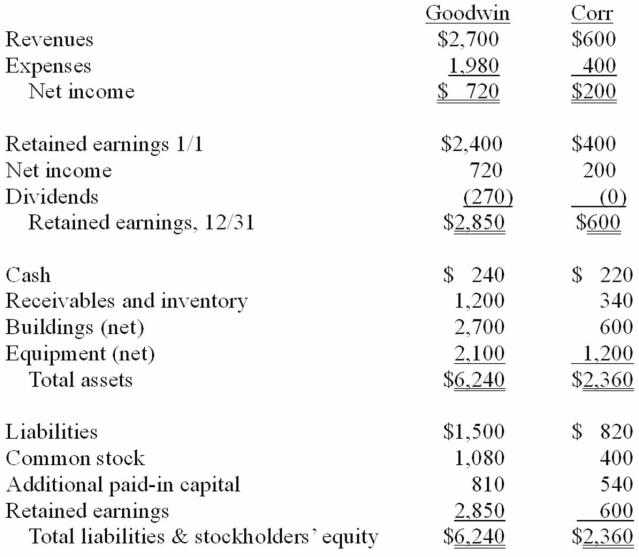

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-In this acquisition business combination, at what amount is the investment recorded on Goodwin's books?

Definitions:

Queue Capacity

The maximum number of items or entities that can wait in line for a service or resource at any one time, influencing the efficiency and effectiveness of service delivery systems.

Work Cycles

The repeated sequence of operations or activities performed in the course of completing a job or task.

Work Station 1

A designated area in a workplace where specific tasks are performed, tailored to the requirements of that task.

Exponentially Distributed

A probability distribution characterized by its constant rate of decline or growth, often used in the study of time until a specific event occurs.

Q10: The balance in the investment account at

Q10: The idea that the largest wars will

Q12: In 2006,Israel fought a brief but intense

Q41: From which methods can a parent choose

Q67: Globalization is _.<br>A)not concerned with terrorism<br>B)focused solely

Q69: Elon Corp.obtained all of the common stock

Q97: Norek Corp.owned 70% of the voting common

Q103: Stevens Company has had bonds payable of

Q105: What amount was recorded as goodwill arising

Q117: What is the balance in Cale's investment