Figure:

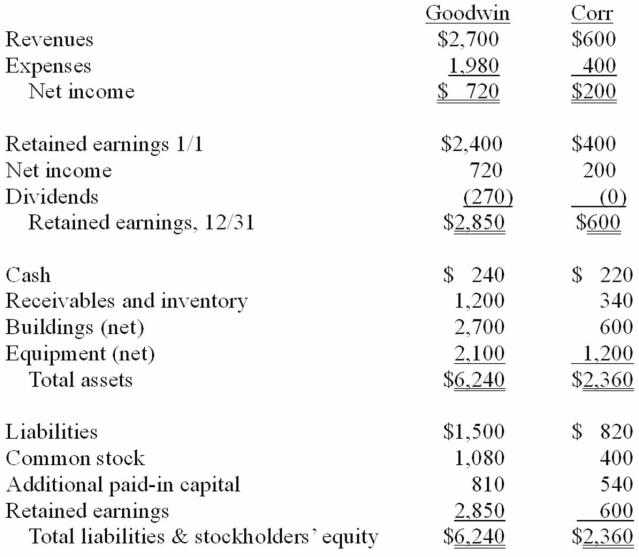

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-In this acquisition business combination, what total amount of common stock and additional paid-in capital is recorded on Goodwin's books?

Definitions:

Transactions

Economic activities or events that affect the financial position of a company, recorded in its accounting records.

Acquisition Costs

The total cost incurred to acquire an asset or service, including the purchase price and any additional costs necessary to bring the asset into working condition.

Property

Legal rights or interests in land, buildings, or other assets, which can include ownership of the asset itself and usage rights.

Equipment

Tangible property used in operations, such as machinery, computers, and tools, that is not intended for sale.

Q3: How much difference would there have been

Q5: Some liberalists have argued that introducing communication

Q19: Which of the following results in an

Q27: Bauerly Co.owned 70% of the voting common

Q38: The _ level of analysis concerns the

Q43: Levels of analysis offer _ explanations for

Q48: Which one of the following is a

Q61: The United States backing the Ethiopian government

Q65: On January 1,2010,Pond Co.acquired 40% of the

Q100: Net cash flow from financing activities was:<br>A)$(28,000).<br>B)$(35,000).<br>C)$(13,000).<br>D)$(63,000).<br>E)$(61,000).