Figure:

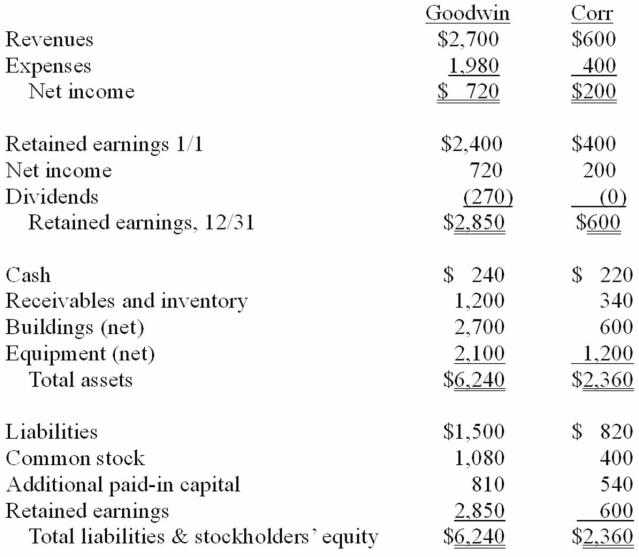

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated receivables and inventory for 20X1.

Definitions:

Inventory Controls

Systems and procedures implemented by a company to manage its inventory efficiently and minimize costs.

Merchandise

Goods that are bought and sold by a business in the regular course of its operation.

Adjusted Trial Balance

A statement prepared after adjusting entries are made, used to verify the balance of debits and credits before preparing financial statements.

End-of-period Spreadsheet

A tool used in accounting to gather all the financial data and adjustments needed to prepare financial statements at the end of an accounting period.

Q2: International regimes _.<br>A)can exist only when there

Q16: How should a permanent loss in value

Q23: On January 1,2011,Jolley Corp.paid $250,000 for 25%

Q25: Which of the following results in a

Q27: If Goehler applies the initial value method

Q28: On January 1,2011,Elva Corp.paid $750,000 for 80%

Q57: The theory that focuses on the importance

Q73: Compute income from Stiller on Leo's books

Q78: Describe how this transaction would affect Panton's

Q104: Compute the consolidated cash upon completion of