Figure:

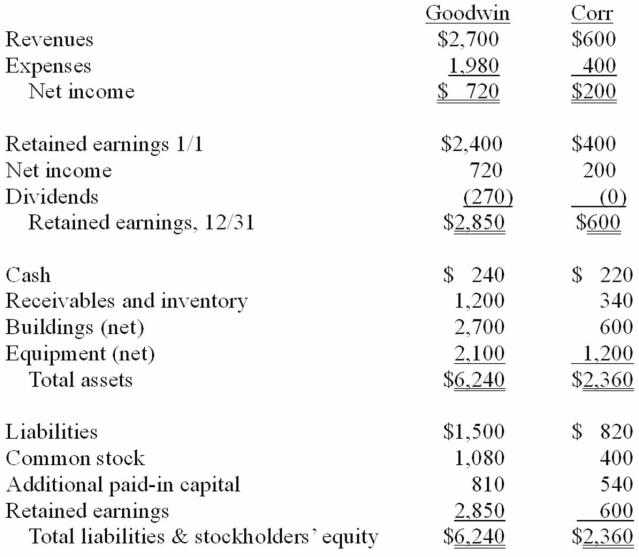

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated cash account at December 31, 20X1.

Definitions:

RLC Series Circuit

An electric circuit consisting of a resistor (R), inductor (L), and capacitor (C) connected in series, creating a circuit with resonant properties.

Circuit Power Factor

A measure of the efficiency of power usage in an electrical circuit, defined as the ratio of real power flowing to the load to the apparent power in the circuit.

Applied Voltage

The electrical potential difference deliberately applied across a component or circuit to drive current through it.

RLC Series Circuit

An electrical circuit consisting of a resistor (R), inductor (L), and capacitor (C) connected in series, displaying complex impedance characteristics.

Q2: Theories of the causes of war at

Q7: Kurds can be considered to be members

Q41: A short-term element of power includes _.<br>A)the

Q43: Some scholars believe that former secretary of

Q45: Compute the amount of consolidated inventories at

Q61: Assume that Bullen paid a total of

Q67: Keefe,Inc. ,a calendar-year corporation,acquires 70% of

Q70: The term _ refers to the number

Q81: Compute the December 31,2013,consolidated land.<br>A)$220,000.<br>B)$180,000.<br>C)$670,000.<br>D)$630,000.<br>E)$450,000.

Q112: What is the amount of consolidated net