Figure:

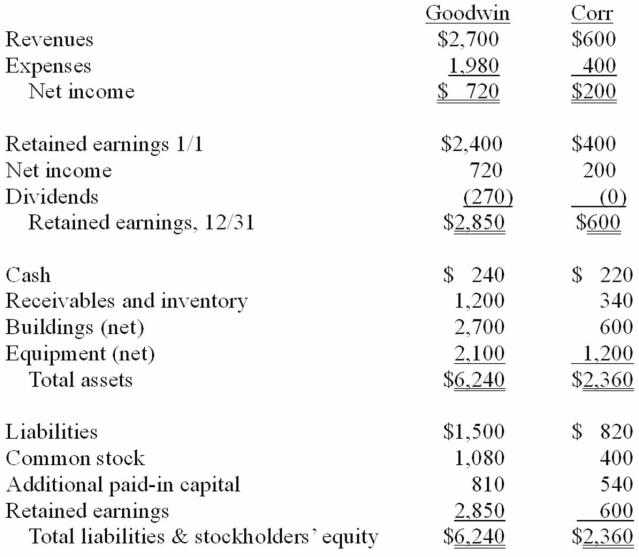

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated equipment (net) account at December 31, 20X1.

Definitions:

Top Management Team

The group of high-ranking executives who are responsible for determining the strategic direction and policies of an organization.

Turnaround Strategy

Strategic actions taken by a company to reverse a period of decline or poor performance and achieve financial recovery.

Workforce

The collective group of people who work in an organization or are available to work in a country or area, including both the employed and the unemployed.

Cost Leadership Strategy

A business approach aimed at becoming the lowest cost producer in an industry, allowing it to undercut competitors on price while maintaining profitability.

Q9: Yaro Company owns 30% of the common

Q12: Compute the amount of total expenses reported

Q39: The equity in income of Sacco for

Q40: Racer Corp.acquired all of the common stock

Q62: In 2011,Osama bin Laden was killed by

Q81: In consolidation at January 1,2010,what adjustment is

Q84: A subsidiary issues new shares of common

Q91: Compute consolidated long-term liabilities at the date

Q94: In the consolidation worksheet for 2011,assuming Carter

Q95: All of the following are examples of