Figure:

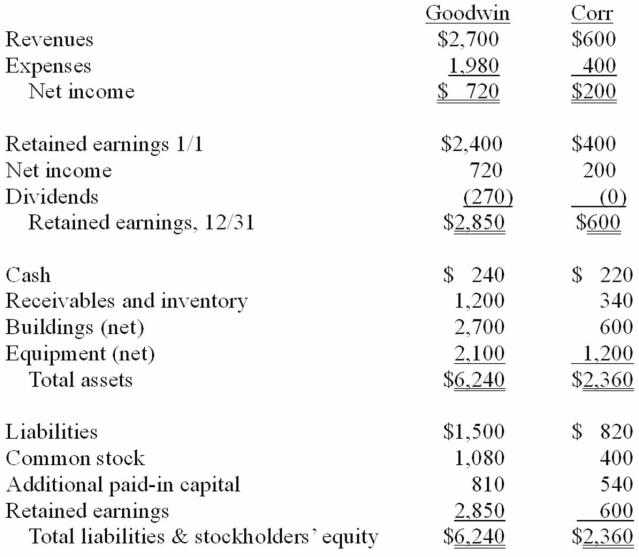

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the goodwill arising from this acquisition at December 31, 20X1.

Definitions:

Vitamin B12

An essential vitamin necessary for the normal functioning of the brain and nervous system, and for the formation of blood.

Pernicious Anemia

An autoimmune disorder that prevents the body from absorbing vitamin B12, leading to a severe type of anemia.

Vitamin A

An essential fat-soluble vitamin important for vision, immune function, and skin health, occurring naturally in foods like carrots, spinach, and liver.

Night Blindness

A condition characterized by difficulty seeing in low light or darkness, often due to vitamin A deficiency.

Q2: Which is a concern connected to the

Q5: Cognitive balance,or the maintenance of a logically

Q20: Davidson,Inc.owns 70 percent of the outstanding voting

Q40: Racer Corp.acquired all of the common stock

Q57: What was the noncontrolling interest's share of

Q65: For consolidation purposes,what net debit or credit

Q87: A company has been using the equity

Q95: All of the following are examples of

Q108: In the consolidation worksheet for 2011,assuming Carter

Q112: The noncontrolling interest's share of the earnings