Figure:

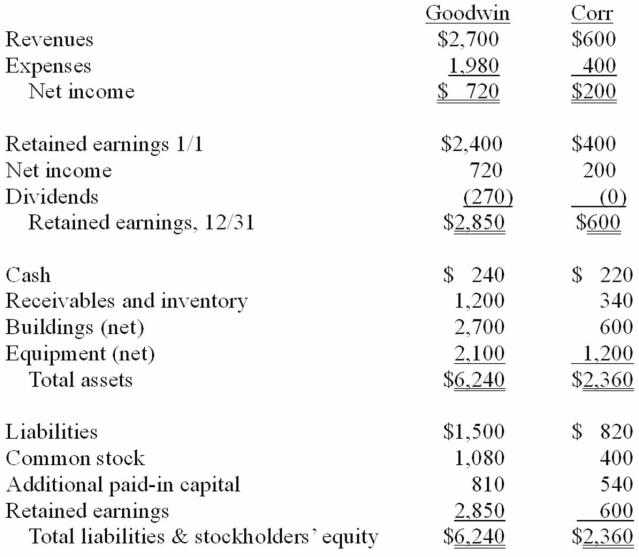

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated additional paid-in capital at December 31, 20X1.

Definitions:

Primary Circular Reactions

A concept in child development where an infant learns to reproduce an event that initially occurred by accident (e.g., sucking their thumb).

Centration

A cognitive limitation in early childhood, where a child focuses on one aspect of a situation while ignoring others.

Neural-Visual Network

A system in the brain that processes visual information, integrating it with neural signals for perception and understanding.

Numerical Understanding

The ability to comprehend, interpret, and work with numbers.

Q26: According to the text,the best single indicator

Q36: Recently,_ began capturing large cities in central

Q37: How does the great power system of

Q48: Which one of the following is a

Q51: A parent company owns a controlling interest

Q59: Which statement about international regimes is true?<br>A)They

Q73: Compute the December 31,2013,consolidated revenues.<br>A)$1,400,000.<br>B)$800,000.<br>C)$500,000.<br>D)$1,590,375.<br>E)$1,390,375.

Q85: The consolidation entry at date of acquisition

Q88: Which of the following is not a

Q116: Compute the December 31,2013,consolidated additional paid-in capital.<br>A)$210,000.<br>B)$75,000.<br>C)$1,102,500.<br>D)$942,500.<br>E)$525,000.