Figure:

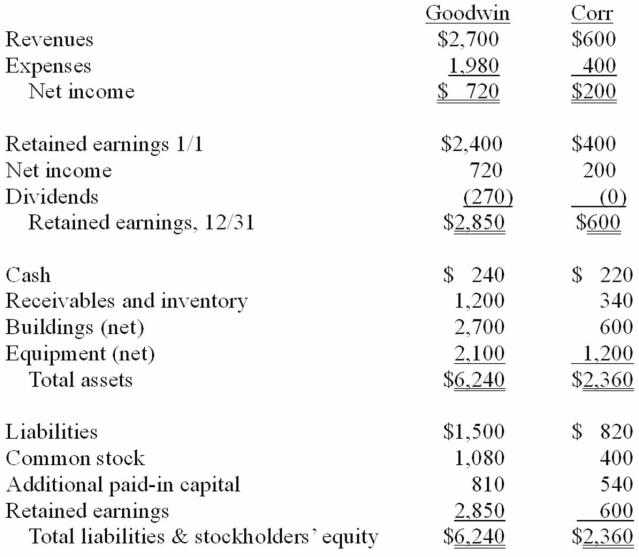

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated retained earnings at December 31, 20X1.

Definitions:

Exponential Distribution

The exponential distribution is a continuous probability distribution used to model the time or space between events in a Poisson process.

Density Function

A mathematical function that specifies the probability of a random variable taking on certain values.

Parameter

A quantity that influences the output or behavior of a mathematical function or statistical model, often fixed during the analysis.

Exponential Random Variable

A type of continuous random variable that is used to model time until an event occurs, with a constant hazard rate.

Q10: Hanson Co.acquired all of the common stock

Q22: In consolidation at December 31,2010,what adjustment is

Q38: Determine the amortization expense related to the

Q39: In terms of their beliefs about objectivity,peace

Q44: Conflicts between middle powers and smaller states

Q64: The _ relatively rich industrialized countries and

Q66: What term is used to refer to

Q69: Diplomats _.<br>A)are career civil servants,not political appointees<br>B)work

Q69: Which one of the following accounts would

Q71: In consolidation at January 1,2010,what adjustment is