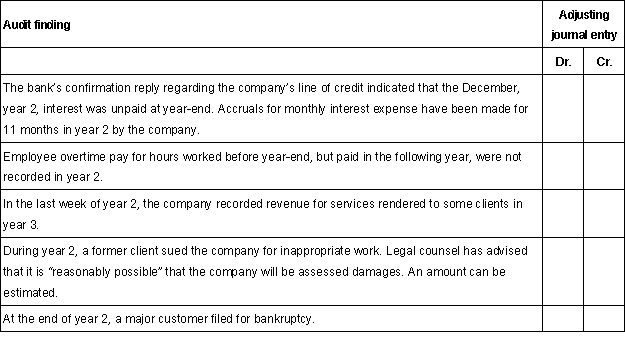

During the course of the year 2 audit of Smithsone Company, the auditor discovered the following situations that may or may not require an adjusting journal entry. Each audit finding is independent of any of the other findings. Select the account or accounts that would comprise the adjusting journal entry, if required, to correct the audit finding. Accounts may be used once, more than once, or not at all.  Selection list for amount

Selection list for amount

Definitions:

Explicitly Told

Information or instructions that are conveyed in a direct, clear, and unambiguous manner, leaving no room for misinterpretation or inference.

Discussing Information

The process of sharing and deliberating on data, facts, and knowledge among a group of people.

Socioemotional Interactions

Exchanges between individuals that involve emotional support, social connection, and the expression of feelings.

Integrated TMS

Refers to a type of Transactive Memory System where group members integrate their knowledge and skills effectively, enhancing the collective memory and problem-solving capabilities of the team.

Q3: Which of the following fraudulent activities most

Q10: Which of the following best describes the

Q18: Which of the following is the best

Q28: Which of the following are Trust

Q28: The Miscellaneous Revenue account should only be

Q28: An auditor plans to examine a sample

Q29: Which of the following is the best

Q51: Which of the following is true about

Q58: According to the Internal Revenue Code §162,

Q79: A significant deficiency:<br>A) Differs from a material