Based on the company and its environment, including its internal control, the auditors assessed the risk of material misstatements to the financial statements, whether due to error or fraud, and designed the nature, timing, and extent of further audit procedures to be performed.

As a result of conducting the above risk assessment procedures, the audit plan for year 2 includes the following changes from the audit plan for year 1. The company has a calendar year-end and operates only on weekdays.

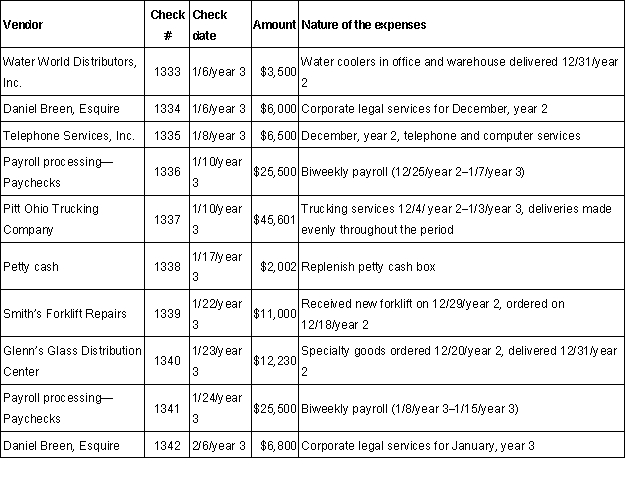

In conducting the audit procedures for the search for unrecorded liabilities, the materiality/scope for this area was assessed by the auditors at $6,000. Adjustments are only recorded for items equal to, or exceeding materiality. The last day of fieldwork is estimated to be February 1, year 3.

For the items reflected in the following check register, which are not recorded in the accounts payable subsidiary ledger at December 31, year 2, determine if each potential liability is recorded in the proper accounting period and also determine the amount that should be journalized, if any. If no action is required, you must enter $0.

For each of the check numbers in the table below, double-click on each of the associated shaded cells and select from the lists provided if any action or adjustment is required, as well as the dollar value of the required adjustment. Each selection may be used once, more than once, or not at all.

Check Register  Selection list for adjustment needed Selection list for amount

Selection list for adjustment needed Selection list for amount

Definitions:

Extensor Digitorum Longus

The extensor digitorum longus is a muscle in the lower leg that helps to extend the toes and the foot.

Range Of Motion

The full movement potential of a joint, usually its range of flexion and extension; important in assessing flexibility and mobility.

Lower Limb

The part of the body extending from the hip to the toes, including the thigh, leg, and foot.

Greater Number

Greater Number signifies a quantity larger than another quantity being compared.

Q3: In order to deduct a portion of

Q4: Your client left the cash receipts journal

Q23: The review of audit working papers by

Q24: Independence is required for the performance of

Q31: Auditors must be concerned with events that

Q35: Auditors may use positive and/or negative forms

Q40: Which of the following accounting changes requires

Q58: Which of the following is not a

Q65: A service auditor's report on a service

Q83: Teal Corporation has 2,000 accounts receivable, with