Based on the company and its environment, including its internal control, the auditors assessed the risk of material misstatements to the financial statements, whether due to error or fraud, and designed the nature, timing, and extent of further audit procedures to be performed.

As a result of conducting the above risk assessment procedures, the audit plan for year 2 includes the following changes from the audit plan for year 1. The company has a calendar year-end and operates only on weekdays.

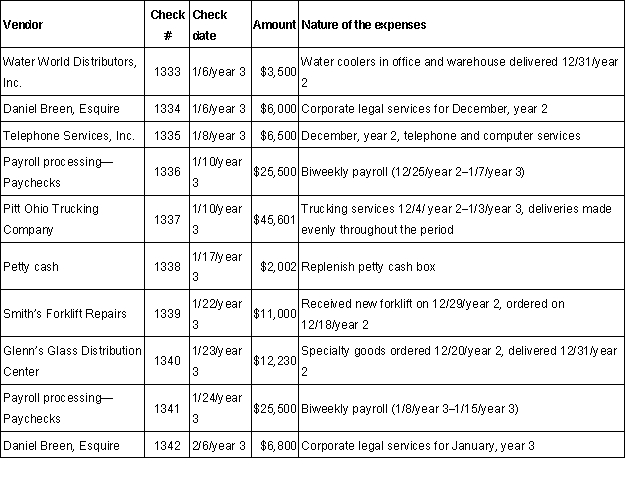

In conducting the audit procedures for the search for unrecorded liabilities, the materiality/scope for this area was assessed by the auditors at $6,000. Adjustments are only recorded for items equal to, or exceeding materiality. The last day of fieldwork is estimated to be February 1, year 3.

For the items reflected in the following check register, which are not recorded in the accounts payable subsidiary ledger at December 31, year 2, determine if each potential liability is recorded in the proper accounting period and also determine the amount that should be journalized, if any. If no action is required, you must enter $0.

For each of the check numbers in the table below, double-click on each of the associated shaded cells and select from the lists provided if any action or adjustment is required, as well as the dollar value of the required adjustment. Each selection may be used once, more than once, or not at all.

Check Register  Selection list for adjustment needed Selection list for amount

Selection list for adjustment needed Selection list for amount

Definitions:

Baby Boomers

Baby Boomers are individuals born during the post-World War II baby boom, approximately between 1946 and 1964, characterized by significant economic prosperity and social changes.

Rites of Passage

Ceremonial events or rituals that mark an individual's transition from one status to another within their society.

30 Year Span

A period of thirty years used as a measure of time to assess or discuss changes, developments, or events.

Age Stratification

The division or categorization of people into different age groups within a society, influencing their roles, rights, responsibilities, and social status.

Q3: For investments in securities accounted for by

Q12: Under the Single Audit Act, the

Q19: Which of the following is most likely

Q20: An audit basically consists of having the

Q22: Passwords for microcomputer software programs are designed

Q37: During a review of the financial statements

Q40: Governmental entities and other recipients of

Q46: The auditors who become aware of an

Q55: Which of the following types of expenditures

Q57: Effective internal control for purchases generally can