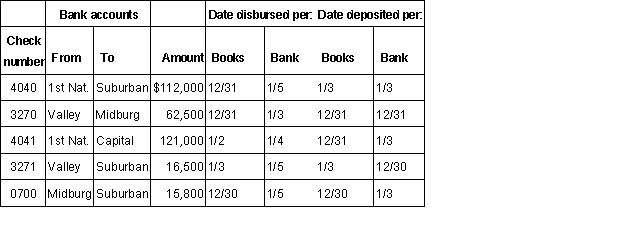

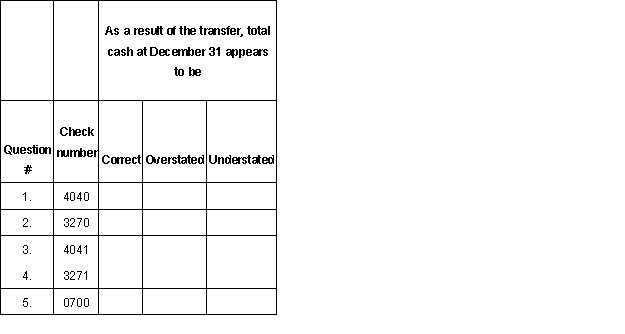

Flemco has made a series of transfers between bank accounts near year-end, some through inter-bank wired transfers and some through checks. You have audited the wired transfers and agree that they have been properly stated and now have the following schedule of transfers between cash accounts made using checks. You may assume that dates per bank are correct, and that dates per books are the dates the transactions were recorded in the books.  Analyze each of the above transfers and determine whether you believe each causes total cash to most likely be correct, overstated, or understated as of year-end.

Analyze each of the above transfers and determine whether you believe each causes total cash to most likely be correct, overstated, or understated as of year-end.

Definitions:

Expected Dividend

The forecasted amount of dividend payments that an investor anticipates receiving from investments in stocks.

Tracking Stock

A type of stock issued by a parent company that tracks the financial performance of a particular division or subsidiary without conferring ownership.

Dual-Class Shares

Dual-class shares are a type of stock structure where different classes of shares provide different rights, typically voting power, to shareholders.

Stock Valuation Model

A method or approach used to estimate the intrinsic value of a stock, helping investors decide whether to buy, sell, or hold the stock.

Q3: The assertion most directly addressed when performing

Q15: Which of the following is an effective

Q15: When an independent registrar and stock transfer

Q23: Which of the following would least likely

Q26: The Rotter Company changed accounting principles in

Q30: An auditor identified a material weakness in

Q31: After documenting the client's prescribed internal control,

Q41: Which of the following is an advantage

Q66: The auditors will not ordinarily initiate discussion

Q74: Using the difference estimation technique, estimated total