On January 1, 2017, Larmer Corp. (a Canadian company) purchased 80% of Martin Inc, an American company, for US$50,000.

Martin's book values approximated its fair values on that date except for plant and equipment, which had a fair value of US$30,000 with a remaining life expectancy of 5 years. A goodwill impairment loss of US$1,000 occurred during 2017. Martin's January 1, 2017 Balance Sheet is shown below (in U.S. dollars): The following exchange rates were in effect during 2017:

Dividends declared and paid December 31, 2017.

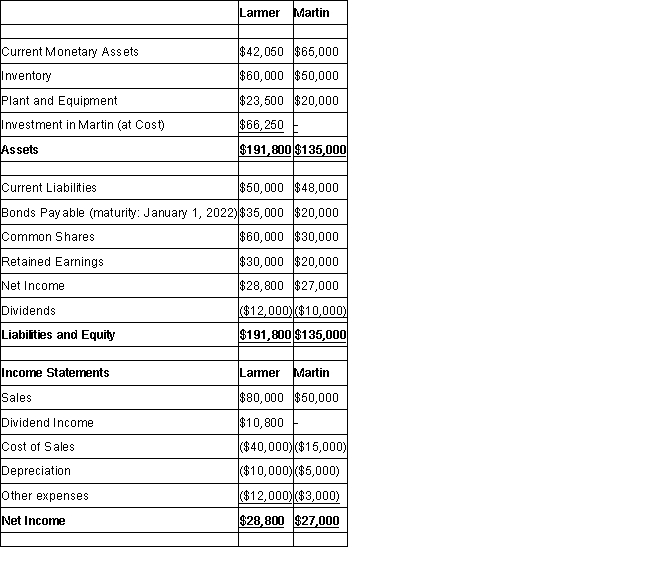

The financial statements of Larmer (in Canadian dollars) and Martin (in U.S. dollars) are shown below:

Balance Sheets

-Translate Martin's 2017 Income Statement into Canadian dollars if Martin is considered to be an integrated foreign subsidiary (i.e., the functional currency of the foreign operation is the same as the parent).

Definitions:

Platelets

Small, disc-shaped blood cells important in blood clotting and preventing hemorrhage.

Pulmonary Circuit

The path of blood flow from the heart to the lungs for oxygenation and back to the heart.

Pulmonary Veins

The veins that transfer oxygenated blood from the lungs to the left atrium of the heart.

Q1: The nurse is preparing new parents for

Q5: List some of the key differences between

Q11: What would be the carrying value of

Q21: The neonatal special care unit nurse is

Q22: The amount of Cash on Big Guy's

Q26: The amount of gross profit appearing on

Q27: A telephone triage nurse gets a call

Q43: ABC123 Inc has decided to purchase

Q53: How much Goodwill will be carried on

Q63: Which of the following journal entries