Use the following information to answer questions 10-12.

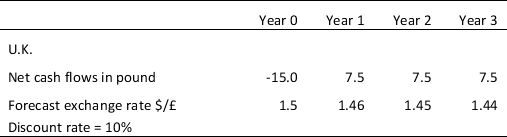

General Candy, Inc., a U.S. firm, manufactures and sells candies worldwide. Because of a rising price of sugar in the U.S., the company is considering to build a new plant in the U.K. The plant will cost £15 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the British government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.1:

-Refer to Table 9.1.The net present value NPV of this project in U.S.dollar is estimated at:

Definitions:

Multiskilled Health Professional

A healthcare worker trained to perform various duties across different domains, enhancing versatility and efficiency in medical settings.

Phlebotomy Technician

A healthcare professional trained to draw blood from patients for various medical testing, transfusions, or donations.

ECG Technician

A healthcare professional specialized in performing electrocardiograms, which monitor the electrical activity of the heart.

Surgical Technician

A healthcare professional who assists during surgeries by preparing the operating room, arranging equipment, and helping doctors during medical procedures.

Q3: The preferred habit theory of term structure

Q8: Which of the following options correctly reflect

Q9: An example of a fixed exchange rate

Q13: A foreign currency option gives the purchaser

Q14: The approach in cultural anthropology that focuses

Q19: The surprisingly low level of international assets

Q24: Because foreigners hold a greater claim to

Q27: Biological determinism is opposed to the perspective

Q37: Which of the following are possible explanations

Q62: A forward premium occurs when:<br>A) The forward