Use this information to answer questions 13-15.

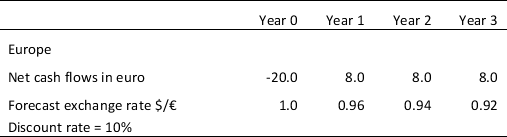

Big Can, Inc., a U.S. firm, manufactures and sells aluminum cans worldwide. Because of a rising price of aluminum in the U.S., the company is considering to build a new plant in Europe. The plant will cost €20 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the European government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.2

-Refer to Table 9.2.The net present value NPV of this project in U.S.dollar is estimated at:

Definitions:

Empirical Findings

Results or data gathered through observation and experimentation.

Dual Code Hypothesis

A theory suggesting that visual and verbal information are processed and stored in the brain through two distinct systems.

Verbal Code

A symbolic system used in the representation and communication of messages that can be spoken, written, or signed.

Visual Image

A visual image is a mental representation or picture created by the brain that can be recalled or imagined without the presence of the physical object.

Q7: Multinational cash management is used by the

Q8: If the absolute PPP suggest that the

Q17: In foreign exchange trading, arbitrage has _

Q28: What is a country called if its

Q35: Interpretive anthropology and "thick description" are mainly

Q37: One method of gathering data on people's

Q47: Suppose interest parity holds. There is a

Q49: If the capital is perfectly immobile due

Q50: For an investor, nonsystematic risk can be

Q63: A currency is at a _ when