Use this information to answer questions 13-15.

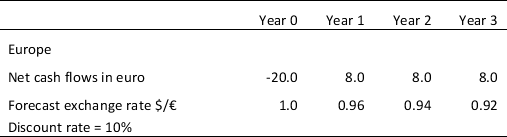

Big Can, Inc., a U.S. firm, manufactures and sells aluminum cans worldwide. Because of a rising price of aluminum in the U.S., the company is considering to build a new plant in Europe. The plant will cost €20 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the European government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.2

-Refer to Table 9.2.Based on the net present value,

Definitions:

Normal Rate

Refers to the standard or usual level at which a particular process occurs or is set, often used in financial contexts such as interest rates.

Return

The gain or loss on an investment over a specified period, expressed as a percentage of the investment’s cost.

Increasing-Cost Industry

An industry in which production costs increase as output expands, often due to factors like resource depletion or increased demand for inputs.

Entry

The act of a new competitor joining a market, which can influence market dynamics, prices, and competitive strategies.

Q3: The overshooting theory by Dornbusch is based

Q19: For U.S. bank to set up an

Q26: If a bicycle costs $200 in the

Q28: When the domestic currency appreciates, the IS

Q30: Assume that the annualized forward premium is

Q31: Karl Marx referred to industrial workers as<br>A)the

Q34: The forward exchange swap is a process

Q38: An) _ letter of credit where the

Q39: The real exchange rate is equal to

Q49: Assume that U.S. imports and exports both