Use the following information for 14-15.

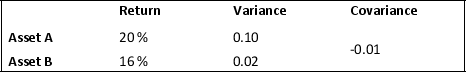

Assume that you have a choice of two assets, A and B, and a portfolio of an equal share of the two assets. Assume also that the assets have the following statistics:

Table 10.1:

-See Table 10.1.If your portfolio includes a combination of 20% Asset A and 80% Asset B,then your expected return is:

Definitions:

Z-Scores

Standardized scores that indicate how many standard deviations an element is from the mean of its data set.

Standard Deviations

A measure of the amount of variation or dispersion of a set of values, indicating how much the values in the set depart from the mean.

Z-Scores

Standardized scores that indicate by how many standard deviations an element is from the mean.

Z-Score

Another term for standard score, indicating the number of standard deviations a data point is from the mean of its distribution.

Q10: A U.S. firm has a €1 million

Q19: Letters of credit are used because:<br>A) Subsidiaries

Q25: The U.S. Internal revenue service requires subsidiaries

Q26: Corruption practices by government officials threatens market

Q26: Which of the following is NOT a

Q40: The double-entry bookkeeping for the balance of

Q40: Under an assumption of perfect capital mobility,

Q51: During Christa Salamandra's research in Damascus, Syria,

Q64: According to the ethical guidelines of the

Q68: The reproductive patterns of the Hutterites and