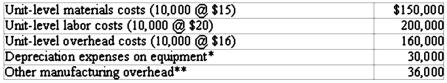

The Enhanced Products Division of Forrest Industries makes ceramic pots that are used to hold large decorative plants. During 2013, the division produced 10,000 pots and incurred the following costs:

*The equipment was purchased for $150,000 and has a current book value of $120,000, remaining useful life of four years, and a zero salvage value. If the company does not use the equipment, it can be leased for $8,000 per year.

**Includes supervisors' salaries and rent for manufacturing plant.

Required:

The division is considering replacing the equipment used to manufacture its ceramic pots. Replacement equipment can be purchased at a price of $200,000. The new equipment, which is expected to last 4 years and have a salvage value of $20,000, will reduce unit-level labor costs by 25 percent. Assuming the division desires to maintain its production and sales at 10,000 ceramic pots per year, prepare a schedule that shows the relevant cost of operating the existing equipment versus the cost of operating the new equipment. Should the existing equipment be replaced? Why or why not?

Definitions:

VM

A Virtual Machine (VM) is a software computer that, like a physical computer, runs an operating system and applications.

Internet Connectivity

The state or quality of being connected to the internet, allowing for the access and exchange of data.

Hyper-V

A virtualization technology developed by Microsoft that allows users to create and manage virtual machines on a Windows-based system.

Virtualize

The process of creating a virtual (rather than actual) version of something, including but not limited to virtual computer hardware platforms, storage devices, and network resources.

Q35: Distinguishing between product and period costs is

Q52: Greenville Company estimates sales of 12,000 units

Q55: Bristles Hair Salon is considering installing

Q68: Biden Department Store has four departments:

Q70: How would a company use target pricing

Q73: Marsden Company has three departments occupying

Q78: Bonnie's Bakery is a relatively small company

Q111: Select the incorrect statement regarding sunk costs.<br>A)

Q126: Bates Company plans to add a new

Q186: At the break-even point:<br>A) Sales would be