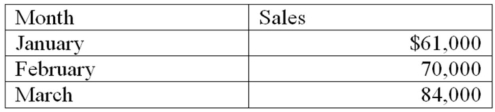

Rosen Hardware Company recorded the following sales for the first quarter of 2014:

These amounts do not include sales taxes. The company is in a state with a sales tax rate of 6 percent.

Required:

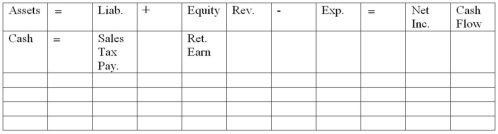

a) Calculate the amount of sales tax that the company collected from its customers for each month.

b) For each month, indicate the effect of the sales and collection of sales tax on the statements model, below. Show dollar amounts of increases and decreases; enter NA if an item is not affected. In the cash flows column, designate cash flows as operating activities (OA), investing activities (IA). or financing activities (FA).

c) On March 31, Rosen Hardware remitted to the state the total amount of sales tax for the quarter. Indicate in the statements model the effect of this transaction.

Definitions:

Supernatural Theories

Theories that see mental disorders as the result of supernatural forces, such as divine intervention, curses, demonic possession, and/or personal sins; mental disorders then can be cured through religious rituals, exorcisms, confessions, and/or death.

Psychological Theories

Concepts or models developed to understand the mind, behavior, and interpersonal relationships through various frameworks.

Social Status

The position or rank of a person or group within the social hierarchy, often influenced by factors such as occupation, income, heritage, education, and power.

Gender Differences

Variations in characteristics, behaviors, physical development, roles, and psychological attributes between males and females.

Q21: Which of the following would not be

Q65: Articles of incorporation, prepared by a business

Q68: Making one employee responsible for authorization and

Q69: Indicate which of the following items

Q84: When debt is used to finance the

Q86: Which ratios measure a company's long-term debt

Q124: Indicate whether each of the following statements

Q128: Which of the following represents the normal

Q162: A qualified opinion means that the financial

Q184: Which of the following is not a