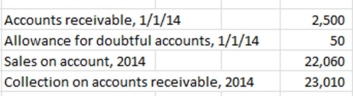

The following information is available for K.M.R. Company, which uses the allowance method of accounting for uncollectible accounts.

K.M.R. estimates that 1% of sales on account will be uncollectible. After several attempts at collection during 2014, K.M.R. wrote off an account of $200 that could not be collected.

Required:

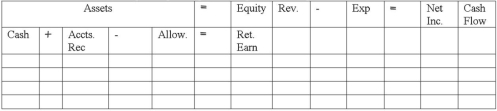

Indicate the effects on the financial statements of the following events:

a) 2014 sales

b) 2014 collections on account

c) Write-off of the uncollectible account

d) Uncollectible accounts expense for 2014

Round amounts to nearest dollar. Show amounts of increases and decreases. For cash flows, indicate whether they are operating, investing, or financing activities.

Definitions:

Operating Activities

Activities that relate to the primary operations of a company, such as selling goods and services, which are reflected in the cash flow statement.

Depreciation Expense

The methodical distribution of a tangible asset's cost throughout its usable life.

Net Income

The total earnings of a company after all expenses and taxes have been deducted from total revenue, often referred to as the bottom line.

Accounts Receivable

Money owed to a company by its customers for products or services that have been delivered but not yet paid for.

Q12: Indicate how each event affects the

Q20: James Company paid $1,800 for one year's

Q21: Indicate how each event affects the

Q57: On December 31, 2014, the Landon Corporation

Q57: Check no. 147 for $200 was outstanding

Q87: Indicate how each event affects the

Q108: The term "recognition" means to report an

Q134: Indicate how each event affects the

Q147: Cash is most susceptible to embezzlement at

Q156: In a company's bank reconciliation, an outstanding