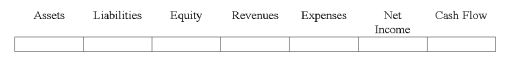

Indicate how each event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. You do not need to enter amounts.

Green Bay Corporation used the allowance method to account for uncollectible accounts expense. On June 20, 2014, Green Bay wrote off an uncollectible account in the amount of $3,000. On September 1, 2014, the account was collected. How would the appropriate entries on September 1 affect the financial statements?

Definitions:

Annual Interest Rate

The percentage increase in the value of money due to interest, calculated on a yearly basis.

Amortize

The method of distributing a loan into a sequence of set payments across a duration, encompassing both the principal amount and interest.

End-of-Year Payments

Financial disbursements made at the conclusion of a calendar or fiscal year, often related to dividends, bonuses, or debt settlements.

Annual Interest Rate

The percentage increase in money owed or invested over a year, due to interest.

Q1: Describe sole proprietorships, partnerships and corporations, indicating

Q21: Mackie Company provided $25,500 of services on

Q21: On June 1, 2014, Siebens Enterprises loaned

Q26: Describe what is meant by the term

Q43: Houston Company began business operations and experienced

Q55: A single step income statement separates routine

Q76: What type of financial statement matches sales

Q99: The amount of cash on hand, including

Q130: Which of the following would most likely

Q141: How does a classified balance sheet enhance