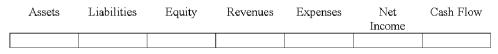

Indicate how each event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. You do not need to enter amounts.

On November 1, 2014, Hardin Company accepted a credit card as payment for $2,000 of services rendered to one of its customers. Assume the credit card fee of 3% is recorded on the date of the sale. Show the effect of the sale and credit card fee on Ulmer's financial statements.

Definitions:

Units-of-Activity

A depreciation method that allocates an asset's cost based on its usage, activities, or units of production rather than the passage of time.

Double-Declining-Balance

A method of accelerated depreciation which doubles the rate at which an asset depreciates compared to the straight-line depreciation method.

Depreciation

The allocation of the cost of a tangible asset over its useful life, reflecting the decrease in value over time due to usage, wear and tear, or obsolescence.

Accumulated Depreciation

The total depreciation amount that has been charged against a fixed asset's cost over its useful life to reflect wear and tear.

Q9: A company may recognize a revenue or

Q31: An asset with a book value of

Q37: Using the effective interest rate method to

Q80: If a company determines that the likelihood

Q103: Which of the following situations provides the

Q106: Indicate whether each of the following statements

Q125: On January 1, 2014, Racine Company purchased

Q129: What is the relationship between gross margin

Q138: For a company that uses a perpetual

Q139: What items are included in the cost