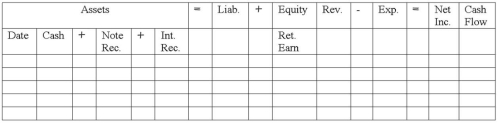

Hines Enterprises loaned $4,000 to Baldwin Company on October 1, 2010, for one year at 8% interest.

Required:

Show the effects on the financial statements model (below) of

a) the loan to Baldwin

b) the adjusting entry at December 31, 2010

c) accrual of interest and collection of the note and related interest on October 1, 2011

Indicate dollar amounts of increases and decreases. For cash flows, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element is not affected by an event, indicate with NA.

Definitions:

Sole Stockholder

A single individual or entity that owns 100% of the shares of a corporation.

Corporate Entity

A corporate entity is a company or group that is authorized to act as a single entity and recognized as such in law, separate from its shareholders.

Promoter

An individual or entity that takes the initiative in founding and organizing a business or enterprise, often before it’s officially established.

Sole Shareholder

An individual or entity that owns 100% of the shares of a corporation, maintaining complete control.

Q45: Explain how the gain or loss is

Q54: On which financial statement(s) does the Cost

Q82: Bruner Company uses the percent of receivables

Q83: On January 1, 2014, Ziskin Company spent

Q93: The Garza Company was started on January

Q102: Which method of depreciation generally allocates the

Q104: Indicate how each event affects the

Q109: The person responsible for making payment on

Q128: Indicate how each event affects the

Q132: Indicate whether each of the following statements