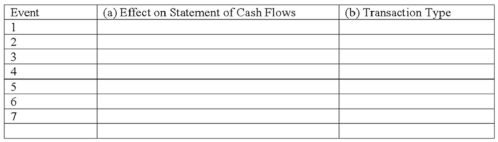

The following transactions apply to Kent Company.

1) Issued common stock for $21,000 cash

2) Provided services to customers for $28,000 on account

3) Purchased land for $18,000 cash

4) Incurred $9,000 of operating expenses on account

5) Collected $15,000 cash from customers for services provided in event #2

6) Paid $7,000 on accounts payable

7) Paid $2,500 dividends to stockholders

Required:

a) Identify the effect on the Statement of Cash Flows, if any, for each of the above transactions. Indicate whether each transaction involves operating, investing, or financing activities and the amount of increase or decrease.

b) Classify the above accounting events into one of four types of transactions (asset source, asset use, asset exchange, claims exchange).

Definitions:

Price Variance

The difference between the actual cost of a good or service and its standard or expected cost.

Product Costs

The total costs incurred to create a product, which include direct materials, direct labor, and manufacturing overhead.

Financial Accounting

The field of accounting focused on the summary, analysis, and reporting of financial transactions relating to a business.

Management Accounting

A branch of accounting that focuses on the preparation and analysis of financial information for internal decision-makers within an organization.

Q3: Describe some instances when targets might attempt

Q6: Briefly summarize some of the major findings

Q11: Interest expense is reported as a non-operating

Q26: Which of the following is the best

Q52: A loss results from a transaction that

Q118: On April 16, 2014, Tuxedo Company purchased

Q119: Under proper internal controls, the person who

Q143: At the beginning of 2012, Gratiot Company's

Q177: Petras Company engaged in the following transactions

Q230: Petras Company engaged in the following transactions