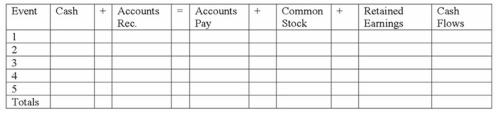

Kramer Corporation began business operations and experienced the following transactions during 2013:

1) Issued common stock for $10,000 cash.

2) Provided services to customers for $40,000 on account.

3) Incurred $18,000 of operating expenses on account.

4) Collected $23,000 cash from customers.

5) Paid $15,000 on accounts payable.

Required:

Record the above transactions on a horizontal statements model to reflect their effect on Kramer's financial statements.

Definitions:

Profitability

The ability of a business to earn a profit, which is the surplus remaining after total costs are deducted from total revenue.

Flexible Benefit Plans

Employee benefit programs that allow workers to choose from a variety of pre-tax benefits to create a package tailored to their personal needs and preferences.

Goal Setting

The process of identifying specific, measurable, attainable, relevant, and time-bound objectives that guide individuals or teams.

Reward Systems

Structures implemented by organizations to recognize and reward employee performance, aiming to motivate and retain talent.

Q7: An adjusting entry that decreases unearned revenue

Q17: The following events pertain to The Craft

Q18: Revenue on account amounted to $4,000. Cash

Q75: The absence of safety deposit boxes means

Q125: Equity represents the future obligations of a

Q137: The term "gain" represents profit resulting from

Q153: Which of the following statements accurately describes

Q160: What is a fidelity bond, and what

Q177: Petras Company engaged in the following transactions

Q213: If a company's total assets decreased while