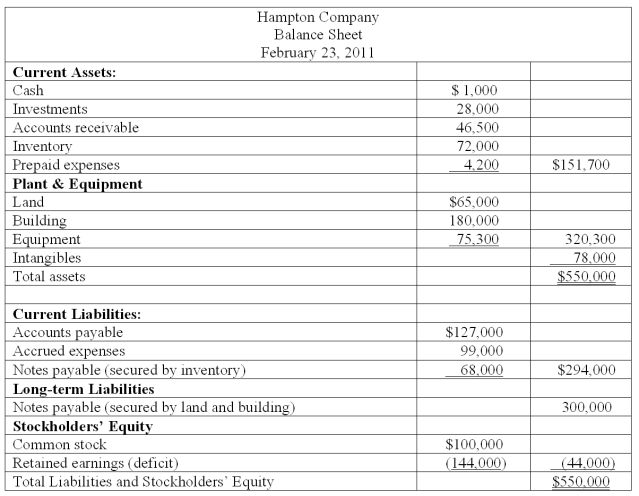

Hampton Company is trying to decide whether to seek liquidation or reorganization. Hampton has provided the following balance sheet:  Additional information is as follows:

Additional information is as follows:

- The investments are currently worth $13,000.

- It is estimated that $32,000 of the accounts receivable are collectible.

- The inventory can be sold for $74,000.

- The prepaid expenses and the intangible assets have no net realizable value.

- The land and building are currently valued at $250,000.

- The equipment can be sold for $60,000.

- Administrative expenses (not yet recorded) are estimated to be $12,500.

- Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees).

- Accrued expenses include $7,000 of unpaid payroll taxes.

-Compute the amount of total assets available to pay liabilities with priority and unsecured creditors.

Definitions:

Material Misstatements

Inaccuracies or omissions of significant information that could influence the decision-making process of users of financial statements.

Registration Statement

A set of documents filed with a regulatory body, such as the SEC, detailing the particulars of a new security to be issued to the public.

Statute of Limitations

Legislation that specifies the longest duration allowed to initiate legal action, varying by the nature of the claim or case.

Private Offering

A method of raising capital through the sale of securities to a relatively small number of selected investors as opposed to a public offering.

Q1: Which one of the following is a

Q7: What was the amount of interest attributed

Q13: Kaycee Corporation's revenues for the year ended

Q25: What was Wasser's capital balance at the

Q27: What factors create a foreign exchange gain?

Q35: Candice Company is currently going through

Q45: On January 1, 2011, a subsidiary bought

Q48: Old Colonial Corp. (a U.S. company)

Q49: Berry Company is going through a

Q62: What assets would be included in the