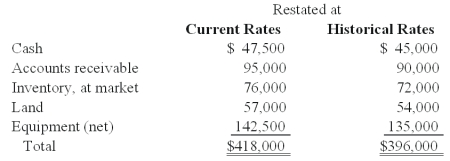

Certain balance sheet accounts of a foreign subsidiary of Parker Company at December 31, 2011, have been restated into U.S. dollars as follows:

-If the current rate used to restate these amounts is $.95, what was the average historical rate used to arrive at the total amount for historical rates?

Definitions:

LIFO Inventory

A method of inventory valuation that assumes the last items placed in inventory are the first sold (Last In, First Out).

Absorption Costing

A costing method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed manufacturing overhead - in the cost of a product.

Variable Costing

An accounting method in which variable manufacturing costs are included in product costs, while fixed manufacturing overhead is treated as an expense of the current period.

Net Operating Income

A financial metric that calculates a company's income after operating expenses are deducted, but before interest and taxes are subtracted.

Q19: How much income tax expense is recognized

Q19: When should property taxes be recognized under

Q23: Withdrawals from the partnership capital accounts are

Q38: Which statement is false regarding the Public

Q39: How much foreign exchange gain or loss

Q56: A U.S. company buys merchandise from a

Q57: Assuming a forward contract was entered into,

Q65: In a Chapter 7 bankruptcy, total assets

Q86: Assume that Boerkian was a foreign subsidiary

Q110: What balances would need to be considered