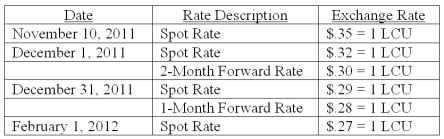

On November 10, 2011, King Co. sold inventory to a customer in a foreign country. King agreed to accept 96,000 local currency units (LCU) in full payment for this inventory. Payment was to be made on February 1, 2012. On December 1, 2011, King entered into a forward exchange contract wherein 96,000 LCU would be delivered to a currency broker in two months. The two month forward exchange rate on that date was 1 LCU = $.30. Any contract discount or premium is amortized using the straight-line method. The spot rates and forward rates on various dates were as follows:  The company's borrowing rate is 12%. The present value factor for one month is .9901.

The company's borrowing rate is 12%. The present value factor for one month is .9901.

-(A) Assume this hedge is designated as a fair value hedge. Prepare the journal entries relating to the transaction and the forward contract.

(B) Compute the effect on 2011 net income.

(C) Compute the effect on 2012 net income.

Definitions:

Dysfunctional

Not operating normally or effectively; causing negative effects.

Production Costs

The costs associated with producing a product or providing a service, which encompass labor, materials, and overhead expenses.

Marginal Cost

The extra expense resulting from the production of a single additional product or service unit.

Fixed Cost

Fixed costs are business expenses that remain unchanged regardless of the level of production or sales, such as rent, salaries, and insurance premiums.

Q3: If newly issued debt is issued from

Q3: Which of the following statements is true

Q13: As a result of the sale and

Q21: Which of the following will be included

Q21: Determine the cash to be retained and

Q25: Which of the following statements is false

Q74: The noncontrolling interest's share of the earnings

Q82: Required:<br>Assume that Boerkian was a foreign subsidiary

Q87: Flintstone Inc. acquired all of Rubble Co.

Q120: For consolidation purposes, what amount would be