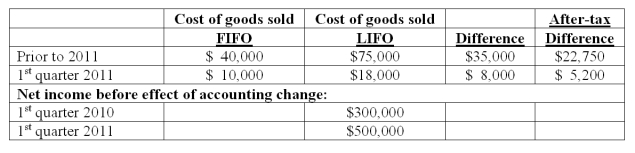

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:

-Assuming Baker makes the change in the first quarter of 2011 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2011?

Definitions:

Operating Income

This refers to the profit a company generates from its normal business operations, excluding any income from investments or non-recurring expenses.

Other Postretirement Benefit Expense

Expenses associated with retirement benefits other than pensions, such as healthcare benefits, recognized during the period employees receive the benefits.

Service Cost

In accounting, refers to the expense recognized for employees' future retirement benefits earned during the current period.

Interest Cost

The total amount of interest on all outstanding debts over a period, representing the cost of borrowing funds.

Q1: Compute the equity in earnings of Gargiulo

Q4: Required:<br>Determine the accrual-based income of Mace Co

Q15: Goehring, Inc. owns 70 percent of Harry,

Q21: Required:<br>Prepare a schedule to show consolidated net

Q40: When a U.S. company purchases parts from

Q50: Which of the following statements is true

Q56: Dotes, Inc. owns 40% of Abner Co.

Q70: Webb Co. acquired 100% of Rand Inc.

Q78: What amount should be included as a

Q98: Assuming that a consolidated income tax return