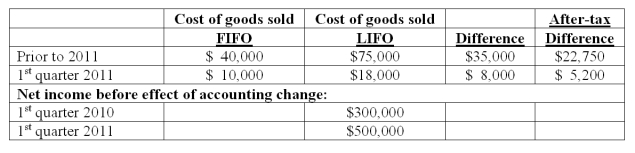

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:

-Assuming Baker makes the change in the first quarter of 2011, how much is reported as net income for the first quarter of 2010?

Definitions:

Feelings Of Inferiority

Emotional states that arise from perceiving oneself as less capable, valuable, or worthy compared to others.

Psychosocial Theory

A framework that suggests an individual's psychological development is influenced by their social environment and interpersonal relations.

Sense Of Industry

The feeling of competence and achievement, typically developed during childhood, especially in response to social and academic demands.

Piaget's Stages

A theory outlining four stages of cognitive development in children, describing how their thinking evolves from simple to complex.

Q18: What is the purpose of the adjustments

Q22: Eden contributed $124,000 in cash to the

Q24: Which one of the following Federal laws

Q25: Meisner Co. ordered parts costing §100,000 for

Q25: Which of the following statements is false

Q27: Which of the following securities offerings is

Q34: What was the amount of the translation

Q74: What amount will Coyote Corp. report in

Q101: Prescott Corp. owned 90% of Bell Inc.,

Q107: Included in the amounts for Skillet's sales