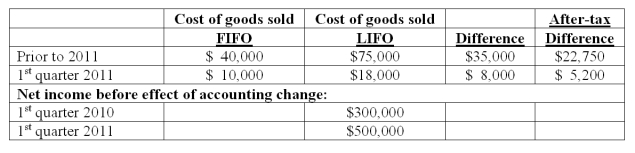

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:

-Assuming Baker makes the change in the first quarter of 2011 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2011?

Definitions:

Lie

An intentionally false statement made with the purpose of deceiving or misleading others.

Declining Significance

A concept that suggests the importance or influence of a particular factor, phenomenon, or entity is diminishing over time.

William Julius Wilson

A prominent American sociologist known for his research and theories on race, class, and inequality within the United States.

Ecological Theory

A framework that explores how individuals interact with their environments, focusing on how these interactions influence development and behavior.

Q3: How should revenues be recognized in interim

Q15: Chain Co. owned all of the voting

Q20: What is the noncontrolling interest in Sigma's

Q36: Compute the noncontrolling interest in the net

Q56: What must Dilty do to ready the

Q58: Gongman Corp. owned the following assets when

Q62: Strayten Corp. is a wholly owned subsidiary

Q89: Assume the functional currency is the euro,

Q92: The accrual-based income of Jade Co. is

Q112: What is the amount of the noncontrolling