On January 1, 2010, Jones Company bought 15% of Whitton Company. Jones paid $150,000 for these shares, an amount that exactly equaled the proportionate book value of Whitton. On January 1, 2011, Whitton acquired 80% ownership of Jones. The following data are available concerning Whitton's acquisition of Jones:

Consideration transferred for 80% interest, January 1, 2011: $800,000

Jones' reported book value, January 1, 2011: 900,000

Excess fair value over book value (assigned to trademarks) is amortized over 20 years.

The initial value method is used by both companies.

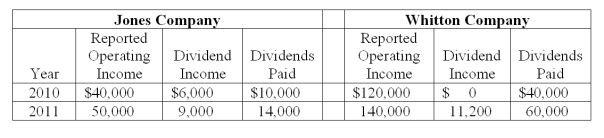

The following information is available regarding Jones and Whitton:

-What would be included in a consolidation worksheet entry for 2011?

Definitions:

Position

Refers to a brand's or product's unique standing and identity in the marketplace relative to its competitors.

Consumers

Individuals or organizations that use economic services or commodities.

Dumping

the practice of exporting goods to another country at a price below the normal charge in the home market, often considered unfair competition.

Market Share

The share of a market dominated by a specific company or product, typically represented as a percent of the overall sales within that market.

Q3: What ownership structure is referred to as

Q14: What is the amount of consolidated net

Q37: If a subsidiary reacquires its outstanding shares

Q40: Dice Inc. owns 40% of the outstanding

Q51: Which of the following statements is false

Q56: What was the purpose of the Securities

Q56: Dotes, Inc. owns 40% of Abner Co.

Q72: Under the partial equity method, the parent

Q72: Compute the December 31, 2011, inventory balance

Q87: Under the temporal method, depreciation expense would