On January 1, 2010, Jones Company bought 15% of Whitton Company. Jones paid $150,000 for these shares, an amount that exactly equaled the proportionate book value of Whitton. On January 1, 2011, Whitton acquired 80% ownership of Jones. The following data are available concerning Whitton's acquisition of Jones:

Consideration transferred for 80% interest, January 1, 2011: $800,000

Jones' reported book value, January 1, 2011: 900,000

Excess fair value over book value (assigned to trademarks) is amortized over 20 years.

The initial value method is used by both companies.

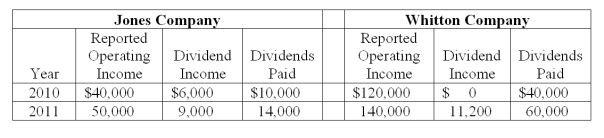

The following information is available regarding Jones and Whitton:

-What is the 2011 consolidated net income for Whitton and Jones companies?

Definitions:

Triangle Arbitrage

A risk-free profit that arises from discrepancies between three foreign currencies in the foreign exchange market.

Profit

The financial gain realized when the revenue from business activities exceeds the expenses, costs, and taxes involved in sustaining the activity.

British Pounds

The official currency of the United Kingdom, also known as sterling, symbolized by £.

Cash Inflows

Funds being received by a company or individual, which could originate from sales, financing, or investments.

Q6: Tara Company owns 80 percent of the

Q11: A company has a discount on a

Q16: Under the partial equity method of accounting

Q33: Under current U.S. tax law for consolidated

Q39: In translating a foreign subsidiary's financial statements,

Q56: A U.S. company buys merchandise from a

Q64: The following account balances are for the

Q82: Which of the following is reported for

Q88: Assuming a forward contract was entered into,

Q105: What is the total noncontrolling interest in