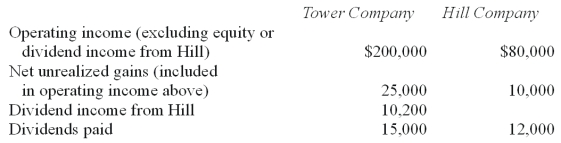

Tower Company owns 85% of Hill Company. The two companies engaged in several intra-entity transactions. Each company's operating and dividend income for the current time period follow, as well as the effects of unrealized gains. No income tax accruals have been recognized within these totals. The tax rate for each company is 30%.

-What is the tax liability for the current year if consolidated tax returns are prepared?

Definitions:

Q16: What is the major objective of segment

Q20: Which of the following statements is false

Q41: Compute Pell's investment in Demers at December

Q43: Vontkins Inc. owned all of Quasimota Co.

Q61: Which operating segments are reportable under the

Q72: Compute the December 31, 2011, inventory balance

Q78: Woods Company has one depreciable asset valued

Q92: In the consolidation worksheet for 2011, which

Q107: What is the noncontrolling interest in Gamma's

Q125: When comparing the difference between an upstream