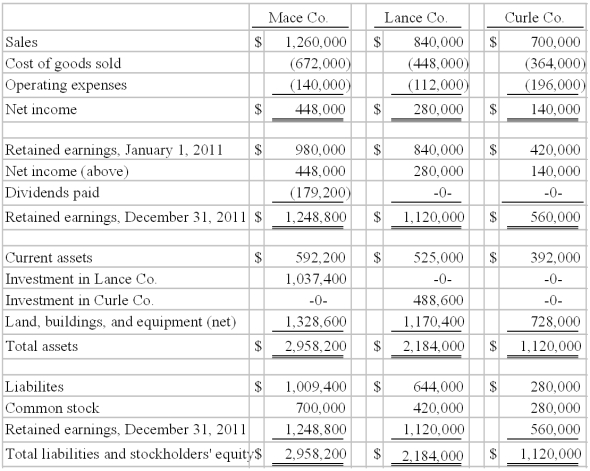

On January 1, 2010, Mace Co. acquired 75% of Lance Co.'s outstanding common stock. On the same date, Lance acquired an 80% interest in Curle Co. Both of these investments were acquired when book value was equal to fair value of identifiable net assets acquired. Both of these investments were accounted using the initial value method. No dividends were distributed by either Lance or Curle during 2010 or 2011. Mace paid cash dividends each year equal to 40% of operating income. Reported operating income totals for 2010 were as follows:  Following are the 2011 financial statements for these three companies. Curle made numerous transfers of inventory to Lance since the takeover: $112,000 (2010) and $140,000 (2011). These transactions included the same markup applicable to Curle's outside sales. In each of these years, Lance carried 20% of this inventory into the succeeding year before disposing of it.

Following are the 2011 financial statements for these three companies. Curle made numerous transfers of inventory to Lance since the takeover: $112,000 (2010) and $140,000 (2011). These transactions included the same markup applicable to Curle's outside sales. In each of these years, Lance carried 20% of this inventory into the succeeding year before disposing of it.

An effective income tax rate of 45% was applicable to all companies.

-Required:

Determine the noncontrolling interest in Lace Co.'s net income for the year 2011.

Definitions:

Qualitative Independent Variable

A variable that categorizes or describes attributes or characteristics, typically non-numeric, influencing the dependent variable.

F-ratio

A statistical value used in the analysis of variance (ANOVA) to compare the variability among group means to the variability within groups.

Explanatory Variables

Variables in a statistical model that are used to explain variation in the outcome or response variable.

Regression Model

A statistical method used to model the relationship between a dependent variable and one or more independent variables.

Q21: Why is the SEC's Rule 14c-3 important

Q28: Tosco Co. paid $540,000 for 80% of

Q30: What happens when a U.S. company sells

Q43: Vontkins Inc. owned all of Quasimota Co.

Q49: What amount should be recognized in 2011

Q69: What was Kuried's balance in the Investment

Q74: Jansen Inc. acquired all of the outstanding

Q75: What amount of goodwill should be attributed

Q105: For an acquisition when the subsidiary retains

Q111: Which of the following statements is true