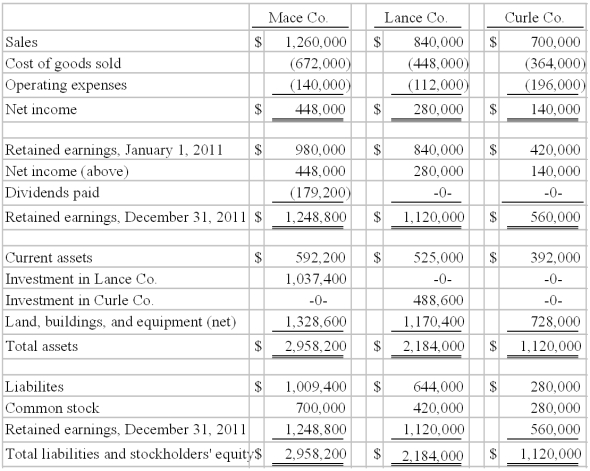

On January 1, 2010, Mace Co. acquired 75% of Lance Co.'s outstanding common stock. On the same date, Lance acquired an 80% interest in Curle Co. Both of these investments were acquired when book value was equal to fair value of identifiable net assets acquired. Both of these investments were accounted using the initial value method. No dividends were distributed by either Lance or Curle during 2010 or 2011. Mace paid cash dividends each year equal to 40% of operating income. Reported operating income totals for 2010 were as follows:  Following are the 2011 financial statements for these three companies. Curle made numerous transfers of inventory to Lance since the takeover: $112,000 (2010) and $140,000 (2011). These transactions included the same markup applicable to Curle's outside sales. In each of these years, Lance carried 20% of this inventory into the succeeding year before disposing of it.

Following are the 2011 financial statements for these three companies. Curle made numerous transfers of inventory to Lance since the takeover: $112,000 (2010) and $140,000 (2011). These transactions included the same markup applicable to Curle's outside sales. In each of these years, Lance carried 20% of this inventory into the succeeding year before disposing of it.

An effective income tax rate of 45% was applicable to all companies.

-Required:

Determine the accrual-based income of Mace Co for the year 2011.

Definitions:

Cognitive Dissonance

A psychological phenomenon where a person experiences discomfort or distress due to holding conflicting beliefs, attitudes, or behaviors simultaneously.

Successful Aging

Maintaining one’s physical health, mental abilities, social competence, and overall satisfaction with life as one gets older.

Cognitive Functioning

Cognitive functioning refers to the mental processes involved in gaining knowledge and comprehension, including thinking, knowing, remembering, judging, and problem-solving.

Physical Health

concerns the functional and metabolic efficiency of an individual's body, reflecting the absence of disease and the state of physical well-being.

Q6: Tara Company owns 80 percent of the

Q6: What information does U.S. GAAP require to

Q16: As a result of research and development

Q25: What is a proxy? Briefly explain the

Q30: How are the operations of the SEC

Q31: Why might a consolidated group file separate

Q56: Dotes, Inc. owns 40% of Abner Co.

Q78: What amount should be included as a

Q86: Larson Company, a U.S. company, has an

Q105: According to U.S. GAAP, which of the