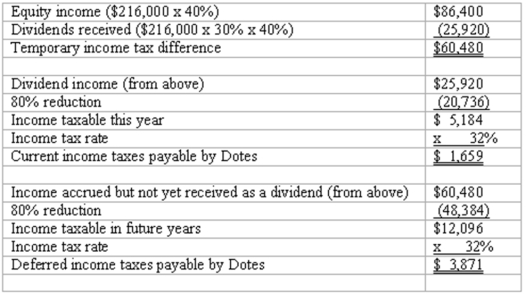

Dotes, Inc. owns 40% of Abner Co. Dotes accounts for its investment using the equity method. Abner follows a policy of paying dividends equal to 30% of its income each year. During the current year, Abner reported net income of $216,000. Dotes has an effective income tax rate of 32%.

Required:

What journal entry would Dotes record at the end of the current year for income taxes relating to the investment in Abner? Assume the investment is to be held for an indefinite time and that all amounts are to be rounded to the nearest dollar.

Definitions:

Musical Ability

Refers to the natural talent or acquired skill in understanding, producing, or interpreting music.

Essential Oils

Concentrated plant extracts that retain the natural smell and flavor, or "essence," of their source.

Aromatherapy

The therapeutic use of essential oils of plants in which the odor or fragrance plays an important part.

Q8: Racer Corp. acquired all of the common

Q18: How is the loss on sale of

Q22: What is the purpose of the SEC's

Q37: At what amount should the equipment be

Q51: Which of the following statements is false

Q57: An intra-entity sale took place whereby the

Q87: Under the temporal method, depreciation expense would

Q90: Which of the following statements is false

Q100: When a parent uses the equity method

Q104: Assume that Icecap sold inventory to Polar