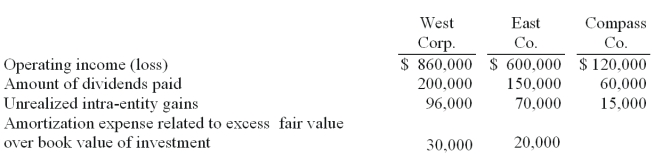

West Corp. owned 70% of the voting common stock of East Co. East owned 60% of Compass Co. West and East both used the initial value method to account for their investments. The following information was available from the financial statements and records of the three companies:  Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary.

Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary.

-The accrual-based income of West Corp. is calculated to be

Definitions:

Stockholders' Equity

The residual interest in the assets of a corporation after deducting its liabilities.

Net Income

The total profit of a company after all expenses, including taxes, have been deducted from revenues.

Common Stock

A type of equity security that represents ownership in a corporation, granting holders voting rights and a share of the profits.

Earnings Per Share

A company's profit divided by the number of common shares outstanding, indicating the profitability on a per-share basis.

Q8: Which of the following statements is true

Q28: Tosco Co. paid $540,000 for 80% of

Q35: The accrual-based income of Maroon Corp. is

Q35: How does the existence of a noncontrolling

Q43: Assuming that a consolidated income tax return

Q50: Compute Pell's investment in Demers at December

Q53: What term is used to describe a

Q57: Assuming that separate income tax returns are

Q62: Regulation S-K:<br>A) controls the listing of securities

Q68: Which of the following statements is true