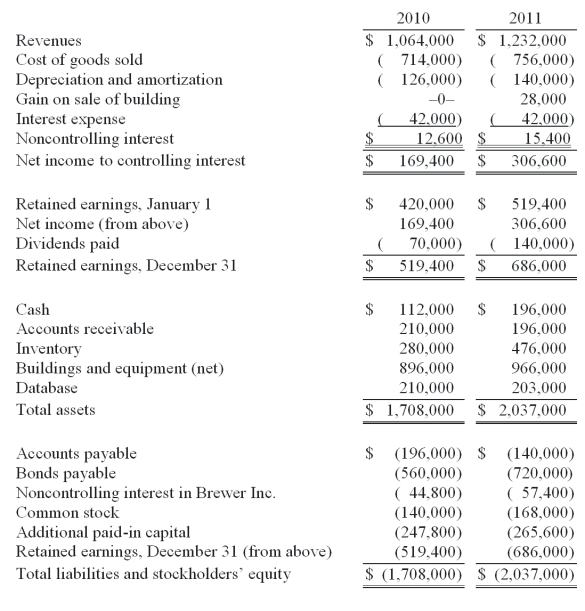

Allen Co. held 80% of the common stock of Brewer Inc. and 40% of this subsidiary's convertible bonds. The following consolidated financial statements were for 2010 and 2011.

Additional Information:

Bonds were issued during 2011 by the parent for cash.

Amortization of a database acquired in the original combination amounted to $7,000 per year.

A building with a cost of $84,000 but a $42,000 book value was sold by the parent for cash on May 11, 2011.

Equipment was purchased by the subsidiary on July 23, 2011, using cash.

Late in November 2011, the parent issued common stock for cash.

During 2011, the subsidiary paid dividends of $14,000.

Required:

Prepare a consolidated statement of cash flows for this business combination for the year ending December 31, 2011. Either the direct method or the indirect method may be used.

Definitions:

Ultimate Consumers

Individuals who buy products or services for personal use and not for manufacture or resale.

Intermediaries

Entities or individuals that act as middlemen in the distribution channel, facilitating transactions between producers and end-users.

Promotional Campaigns

Targeted marketing efforts designed to increase awareness, interest, and sales of a product or service through various tactics such as advertising, sales promotions, and social media marketing.

IMC Campaigns

Integrated Marketing Communications campaigns that use various promotional tools in a coordinated manner to achieve marketing goals.

Q1: In a transaction accounted for using the

Q8: Which of the following would be an

Q10: Determine the amortization expense related to the

Q26: In the consolidation worksheet for 2010, which

Q32: What is the consolidated balance of the

Q62: Pennant Corp. owns 70% of the common

Q69: What is preacquisition income?

Q77: The following items are required to be

Q106: On January 4, 2011, Watts Co. purchased

Q118: At what amount should the equipment (net