On January 1, 2011, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired.

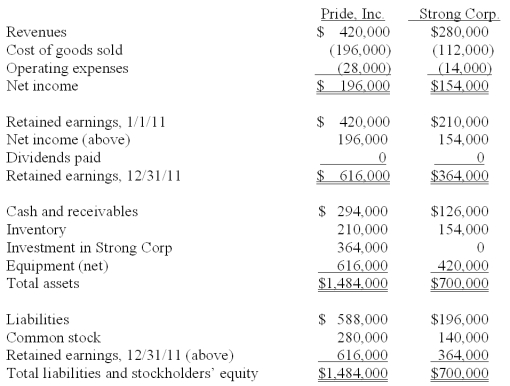

As of December 31, 2011, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

-What is the consolidated total for inventory at December 31, 2011?

Definitions:

Intrapreneur

An employee within a company who promotes innovative product development and marketing by leveraging entrepreneurial skills.

Research and Development

A business or government activity that involves the investment of resources in innovation and improvement of products, services, or processes.

Effective Communication

Communication whereby the right people receive the right information in a timely manner.

Innovation

The process of introducing new ideas, methods, or products to improve efficiency, effectiveness, or competitive advantage.

Q6: How would consolidated earnings per share be

Q12: All of the following statements regarding the

Q21: Beta Corp. owns less than one hundred

Q36: Compute Cody's undistributed earnings for 2011.<br>A) $62,500.<br>B)

Q65: On January 1, 2011, Bangle Company purchased

Q71: What amount will be reported for consolidated

Q79: A foreign subsidiary of a U.S. corporation

Q96: Compute income from Stiller on Leo's books

Q109: How do upstream and downstream inventory transfers

Q113: Horse Corporation acquires all of Pony, Inc.