Several years ago Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transaction.

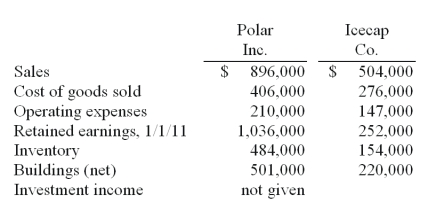

The following selected account balances were from the individual financial records of these two companies as of December 31, 2011:

-Assume that Icecap sold inventory to Polar at a markup equal to 25% of cost. Intra-entity transfers were $70,000 in 2010 and $112,000 in 2011. Of this inventory, $29,000 of the 2010 transfers were retained and then sold by Polar in 2011 whereas $49,000 of the 2011 transfers were held until 2012.

Required:

For the consolidated financial statements for 2011, determine the balances that would appear for the following accounts: (1) Cost of Goods Sold, (2) Inventory, and (3) Noncontrolling Interest in Subsidiary's Net Income.

Definitions:

Point System

A method of evaluation or assessment based on allocating points for various criteria or accomplishments.

Immigration Decisions

The determinations made by governments or authorities about who is allowed to enter or stay in a country.

Canadian Society

Describes the social structure, culture, and norms of Canada, a country characterized by its diversity and multiculturalism.

Institutional Discrimination

Policies or practices within institutions that result in unequal treatment or opportunities for members of different groups.

Q5: On January 3, 2011, Jenkins Corp. acquired

Q24: What is the balance in Cayman's Investment

Q33: Compute Pell's income from Demers for the

Q38: The income reported by Dodge for 2011

Q47: Which of the following is false with

Q63: A statutory merger is a(n)<br>A) business combination

Q84: Which of the segments are separately reportable?<br>A)

Q85: Which of the following is reported for

Q112: Which of the following is a not

Q113: The Rivers Co. had four separate operating