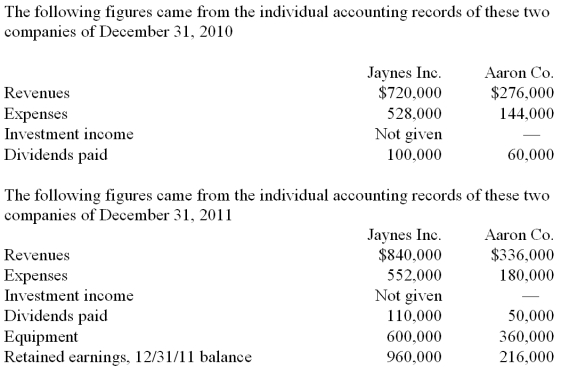

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

-What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2010, when the equity method was applied for this acquisition?

Definitions:

Selling Situation

The context or environment in which a sales transaction takes place, including factors like customer needs, market conditions, and product characteristics.

Planning Phase

The stage in a process, project, or sales strategy where objectives are set, and detailed plans are made to achieve goals.

Negotiation

A tactical conversation that settles a problem in a manner satisfactory to all involved parties.

Metaphors

Figurative language used to represent a concept or an object by referring to another concept or object with similar characteristics.

Q15: Consider the data in Table 2.4. The

Q20: What are the components that make up

Q23: The costs of economic growth include which

Q26: In the consolidation worksheet for 2010, which

Q34: Parent Corporation loaned money to its subsidiary

Q35: On January 1, 2010, Jumper Co. acquired

Q91: What was the noncontrolling interest's share of

Q93: Cadion Co. owned a controlling interest in

Q93: If per capita GDP in 2013 was

Q101: Carlson, Inc. owns 80 percent of Madrid,