Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

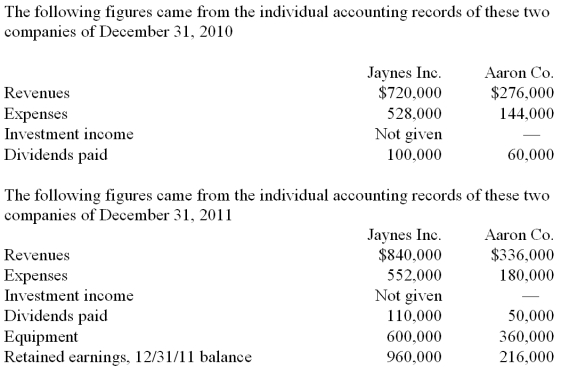

-What was consolidated net income for the year ended December 31, 2011?

Definitions:

Employer

An individual or entity that hires and pays for the services of workers or employees, typically in exchange for their labor.

Torts

Civil wrongdoings that cause harm or loss, leading to legal liability and compensation claims outside of contractual obligations.

Battery

Intentional physical contact or harm to another person without their consent, considered a criminal offense and tort.

Assault

An intentional tort that prohibits any attempt or offer to cause harmful or offensive contact with another if it results in a well-grounded apprehension of imminent battery in the mind of the threatened person.

Q23: How does the partial equity method differ

Q36: A subsidiary issues new shares of common

Q38: Consider Table 2.3. Using the Paasche index,

Q61: Suppose k and l grow at

Q70: Kordel Inc. acquired 75% of the outstanding

Q73: Compute income from Stark reported on Parker's

Q81: Compute the amount of Hurley's land that

Q94: Consider Table 2.3. Using the Laspeyres index,

Q99: What is the amount of goodwill resulting

Q109: How do upstream and downstream inventory transfers