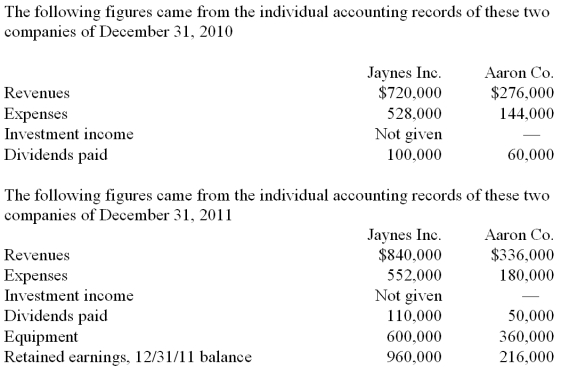

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

-What was consolidated patents as of December 31, 2011?

Definitions:

Parallel Circuit

A circuit in which components are connected across common points or junctions, providing multiple paths for current.

Inductive Reactance

The opposition to the change in current flow in an AC circuit, caused by the inductance of the circuit elements.

Resistor Current

The flow of electric charge through a resistor, influenced by the voltage across the resistor and its resistance, according to Ohm's law.

Parallel Circuit

A circuit configuration where components are connected across common points or junctions, allowing multiple paths for current flow.

Q8: Under the equity method, when the company's

Q12: Which of the following statements is true

Q17: On January 1, 2011, Race Corp. acquired

Q30: If the percent change in real GDP

Q40: Compute Pell's income from Demers for the

Q45: Acquired in-process research and development is considered

Q48: Compute Pell's investment in Demers at December

Q65: At what amount should the equipment (net

Q106: How does a gain on an intra-entity

Q107: Which of the following does NOT count