On January 1, 2009, Rand Corp. issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc. Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share. Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill.

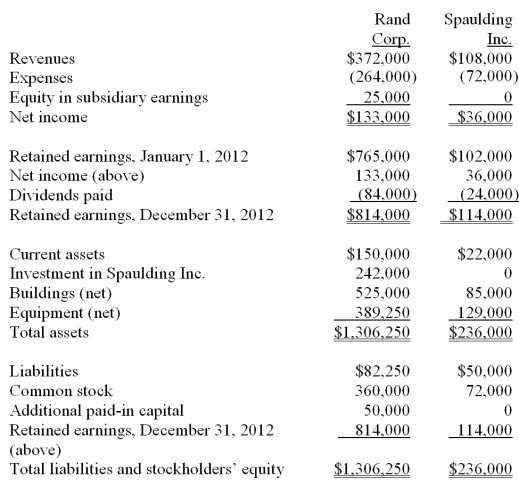

Following are the individual financial records for these two companies for the year ended December 31, 2012.

Required:

Prepare a consolidation worksheet for this business combination.

Definitions:

Likert Scale

A psychometric scale commonly involved in research that employs questionnaires, used to represent people's attitudes or feelings on a linear scale.

Semantic Differential

A type of scale used for measuring the meaning of things and concepts, involving a series of bipolar adjectives.

Wendy's Survey

A method of gathering customer feedback implemented by the Wendy's fast-food restaurant chain, often for quality improvement or market research purposes.

Fast-Food Restaurant

A type of restaurant that offers quick service, convenience, and food that is prepared and served quickly to the customer, often at a lower cost compared to full-service establishments.

Q16: How should a permanent loss in value

Q16: Under the partial equity method of accounting

Q35: Using the expenditure approach, consumption expenditures include

Q36: According to the income approach to GDP,

Q58: The balance in the investment in Sacco

Q59: Pursley, Inc. owns 70 percent of

Q79: If you own your own home, National

Q81: How are direct combination costs accounted for

Q102: Compute the noncontrolling interest in Demers at

Q104: If Watkins pays $300,000 in cash for